Published 2 september 2024

In the discussions on a possible reform of the pension system, the CSL intends to defend the interests of all its members, i.e. current and future retirees.

Let’s strengthen the pension system

The CSL is committed to preserving and even strengthening the public, social and solidarity-based pension system, and rejects any privatisation of the system. Only a high-quality public system can guarantee a decent pension for every retired person.

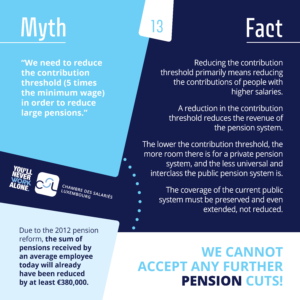

It is important to ensure that the coverage of the system is maintained, or even extended (more opportunities to insure, de-capping the contributory base, etc.), rather than demanding a reduction in the scope of the public system (lowering the contribution cap, for example).

In order to tackle the risk of poverty among pensioners, which has doubled in Luxembourg over the last ten years, the CSL is calling for a substantial increase in the minimum pension. At present, the minimum pension is considerably lower than the at-risk-of-poverty threshold and is not enough to lead a decent life as defined by STATEC. The CSL finds it unacceptable that an insurance career of 40 years or more is insufficient to guarantee older people a decent life without poverty-risk.

A reminder of the 2012 reform

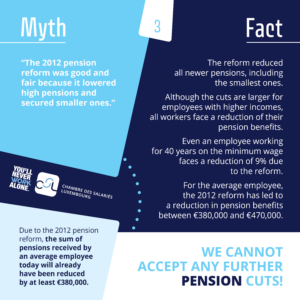

The 2012 pension reform must not be forgotten: the deteriorations introduced by this reform are already enormous and penalise today’s young people in particular.

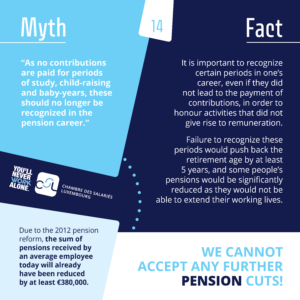

The CSL reminds its members that the 2012 reform has considerably lowered pension levels for all future pensioners, that it leads to the abolition of the end-of-year allowance for current and future pensioners and that it causes pensions to no longer be adjusted to changes in real wages in the future.

For an average employee, the 2012 reform means a loss of between 380,000 euros and 470,000 euros over a 25-year pension period. Even those with very low pensions will suffer considerable reductions as a result of this reform.

All these deteriorations must be borne in mind when discussing a possible new pension reform: pension levels in the future will no longer be the same as today’s pension levels.

Objectivising the debate

The CSL is committed to objectivising the debate by fighting against the erroneous claims being made about the pension system.

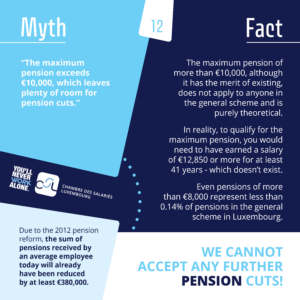

It points out that the outrageous pension levels sometimes put forward to call the public system into question are (almost) non-existent – only 0.14% of pensions in the general pension scheme exceed 8,000 euros, for example.

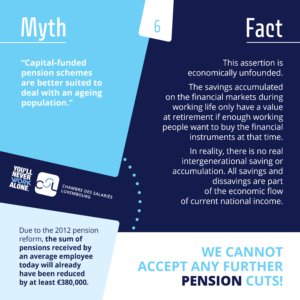

Similarly, the CSL is keen to combat the idea that capitalisation or (even partial) privatisation of the pension system would be the solution to the ageing of the population – this idea is unfounded, as many economists have shown. In reality, capitalised and private systems face the same ageing challenges as pay-as-you-go systems, but on top of that they have considerable disadvantages (riskier, more expensive, less flexible).

The CSL also fights against the idea that an increase in life expectancy should be accompanied by an increase in the retirement age. In the past, life expectancy has risen considerably more than is forecast for the future, and this increase has been easily managed without raising the retirement age. What’s more, a simple increase in the retirement age is not necessarily followed by a reduction in the system’s expenditure in the medium and long term, as a recent study has shown.

Meeting the challenge

Given the ageing of the population, it is perfectly normal for pension expenditure to rise in the future. This is not a fundamental economic problem, since, because of economic growth, an increase in pension spending does not imply that there will be less income to allocate to other purposes.

Indeed, although some projections point to a considerable increase in pension expenditure by 2070 (from 7.1 billion to 35.8 billion euros, constant euros), these same projections predict that, due to economic growth, there will be more than twice as much income left to distribute for purposes other than pensions in 2070 as there was in 2022 (150.1 billion euros compared with 70.1 billion euros, constant euros).

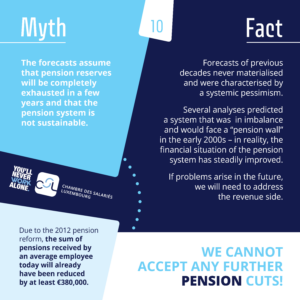

The CSL rejects any decision solely based on projections with time horizons of 50 years, as these projections are by their very nature extremely uncertain. To date, all long-term projections of the pension scheme’s financial standing have turned out to be inaccurate due to systemic pessimism in assumptions. Deeply uncertain figures must not be used to unnecessarily weaken a financially sound system.

If funding problems do indeed arise – a situation that is a long way off, given the huge reserve of over 27 billion euros – it is crucial to provide the system with additional financial resources rather than reducing its expenditure. After all, any quality system can only be guaranteed if it is adequately financed.

Stay informed and follow our recommendations to secure your pension:

For further details about the functioning of the pension system click HERE.

More information: