- CSL

- Opinions

- Position papers

- Your rights

- Employees

- Types of employment

- Trial period

- Remuneration

- Definition of the term “remuneration”

- Wage level

- Collective bargaining agreement wage scales

- Salary supplements

- Premium payments

- Wage indexing

- Payment of wages

- Garnishment and assignment

- What is meant by wage garnishment?

- What part of a person’s salary can be garnished?

- Is garnishment carried out on gross or net pay?

- What happens if several garnishment actions are carried out on a single pay source?

- How is the garnishing of wages carried out in the case of a maintenance claim?

- What is the difference between a garnishment of earnings and an assignment of earnings?

- Deductions from wages

- Working time

- Basic principles

- Who is covered by the legal strictures on working time?

- Who is to be considered a senior manager?

- What is meant by working time?

- How many hours per day and per week can employees work?

- Can an employee have several jobs?

- How is the working week split into days?

- At what time must the employee report to work and what rest period is required during a shift?

- Is an employer entitled to unilaterally change the working hours of employees?

- Can an employer unilaterally change the distribution of weekly working hours over the days of the week?

- Are employers obliged to set up a system for recording working hours?

- Part-time work

- What is meant by part-time work?

- What special information is included in part-time employment contracts?

- Do employers have to offer part-time work to employees who request it?

- Can an employee refuse to work part-time?

- What are the rights of part-time employees?

- Part-time workers and the work organisation plan (WOP): what conditions must be fulfilled?

- Can an employer force a part-time employee to work overtime?

- Minimum rest period

- Overtime

- Sunday work

- Night work

- Work on public holiday

- What employees are involved?

- Which days qualify as legal holidays?

- What happens when a legal holiday occurs on a Sunday?

- What happens when a legal holiday occurs on a working day that has been declared a “working day not worked”?

- What happens when a legal holiday occurs on a working day?

- If a public holiday falls during a period when the employee is off sick, can compensatory leave be awarded later?

- How is work on legal holidays paid?

- How is work on a public holiday that is also a Sunday paid?

- How is work on legal holidays paid in companies working on a seasonal basis?

- What about young workers who work on a legal holiday?

- Are employers required to keep a separate register for holiday work?

- Flexible working time arrangements

- What is meant by flexible working time arrangements?

- What is meant by work organisation plans (WOP)?

- What about overtime in a WOP?

- What are the rules protecting night workers under a WOP?

- What are the rules protecting part-time workers under a WOP?

- What are the rules protecting young workers that form part of the WOP?

- How long can a reference period last?

- What is flexitime?

- Young people

- What are young workers?

- What is meant by working time for young workers?

- What are the limits to working time applicable to young workers?

- What are the young worker's rest periods?

- Can young workers work overtime?

- Can young workers work at night?

- Can young workers work on Sundays or legal holidays?

- Can the working hours of young workers be made flexible?

- Pregnancies

- Time savings account (CET)

- How are time savings accounts set up?

- When was this introduced into the Labour Code?

- How are contributions to a time savings account made?

- How does one use a time savings account?

- How are employees protected?

- How is a time savings account liquidated?

- What are an employer’s obligations?

- What guarantees are in place in case of employer bankruptcy?

- What about current collective bargaining wage scales?

- What is the task of the staff delegation with regard to the time savings account?

- What is the impact of a time-saving account on unemployment benefits?

- What is the tax treatment of time savings accounts?

- Flexible working arrangements

- What are the qualifying conditions?

- What are "flexible working arrangements"?

- How can the employer respond?

- How is the return to the original working arrangement organised?

- Is the employee protected against dismissal?

- Are the employment and the rights attached to it to be maintained?

- Can an employee be subject to reprisals or less favourable treatment?

- What are the penalties for non-compliance?

- CSL publication

- Basic principles

- Changes in working conditions

- Statutory leaves

- Overview

- Annual recreation leave

- Extraordinary leave

- What family event qualifies for extraordinary leave?

- When is an employee entitled to leave for reasons of force majeure?

- How long is the leave for reasons of force majeure?

- What is the caregiver leave?

- How long is caregiver leave?

- What should an employee do if he intends to take leave for reasons of force majeure or carergiver leave?

- Who pays for force majeure leave or caregiver leave?

- How are employees protected during leave for reasons of force majeure or during caregiver leave?

- Who are first- and second-degree relatives?

- Can extraordinary leave be carried over?

- Can a newly hired employee take extraordinary leave without waiting for the three-month period to expire?

- How many times can extraordinary leave for moving house be taken?

- Can extraordinary leave be awarded if the family event occurs during a period of illness?

- If an event occurs during a period of regular leave, is extraordinary leave due?

- Who pays for the extraordinary leave?

- What are the terms and conditions for taking the 10-day leave for the birth or adoption of a child?

- Are part-time employees entitled to the same number of special leave days?

- How can employees in a civil union get extraordinary leave?

- Are employees in a union under foreign law eligible for extraordinary leave?

- Congés liés à la situation familiale

- Training-related leave

- Sports leave

- What is the purpose of sports leave?

- Who is entitled to sports leave?

- What are the conditions for taking sports leave?

- How long does sports leave last?

- Does sports leave count as working time?

- Can sports leave be split?

- Can the duration of sports leave be prorated?

- Is the sports leave cumulative?

- Can sports leave be postponed from one year to the next?

- How do I apply for sports leave?

- Can the employer refuse sports leave?

- How is sports leave paid?

- Leave related to an employee’s status as an elected official

- Development cooperation leave

- What is the purpose of development cooperation leave?

- Who is eligible for development cooperation leave?

- Which type of missions are eligible for development cooperation leave?

- What process should be followed to obtain development cooperation leave?

- How long is development cooperation leave?

- Is development cooperation leave considered as actual working time?

- Special leave for volunteer firefighters

- What is the purpose of special leave for volunteer firefighters?

- Who is eligible for this type of leave?

- What training activities are eligible?

- How much time off do volunteer firefighters get?

- Who should volunteer firefighters apply to for leave?

- Can employers object to the leave?

- Is the leave for relief volunteers considered as a period of actual work?

- Who pays for special leave for volunteer firefighters?

- Leave to seek new employment

- CSL Publication

- Legal holidays

- Which employees are concerned by legal holidays?

- What days qualify as legal holidays?

- What happens if a legal holiday falls on a Sunday?

- What happens when a legal holiday occurs on a working day that has been declared a working day not worked?

- What happens if a legal holiday falls on a working day?

- If a public holiday falls during a period when the employee is off sick, can compensatory leave be awarded later?

- How is work on legal holidays paid?

- How is work on a public holiday that is also a Sunday paid?

- How is work on legal holidays paid in companies working on a seasonal basis?

- What about young workers who work on a public holiday?

- Does the employer have to keep a special register?

- Illness

- Obligations of the employee

- Employer’s obligations

- Termination of contract due to illness

- Health assessments

- Leave entitlement

- Progressive return to work for therapeutic reasons

- What is meant by a progressive return to work for therapeutic reasons?

- How does one apply for a gradual return to work for therapeutic reasons?

- Do I need the employer's consent?

- What are the consequences for the employee?

- Do employees who are progressively returning to work get their entire statutory leave?

- Reclassification

- What does the Social Security Medical Board (CMSS) do with a long-term sick employee?

- What happens if CMSS considers the employee fit for work?

- What happens if CMSS considers that the illness is lasting?

- What happens if the CMSS discovers a disability?

- What happens if CMSS recommends internal or external reclassification?

- Am I protected against dismissal?

- Can I be internally reclassified?

- Can I be reclassified externally?

- CSL publication

- Workplace monitoring

- Which people are protected by law?

- What is meant by personal data?

- What is meant by processing of personal data?

- Who is responsible for the data processing when it is carried out?

- What rules and conditions must be complied with by anyone who intends to set up a personal data processing system?

- When can personal data be processed?

- Under what conditions can an employer process personal data for surveillance purposes in the workplace?

- What are the rights of the person whose data is processed?

- CSL Publication

- Posting of employees

- What is a posted employee?

- To whom do the posting rules apply?

- Under what conditions is a posting possible?

- When can a posting be made?

- What about posting for temporary work agencies or companies that post their employees as a temporary loan of labour?

- What about doubts as to the reality of a posting or as to whether a company carries out a real and substantial economic activity in its country of origin?

- What are the rights of a posted employee?

- What is the maximum duration of a posting?

- What about initial assembly or first-time installation work?

- What about expenses related to the posting?

- What is the process for posting an employee to Luxembourg?

- What are the obligations of the principal or the client?

- What are the obligations of a client with regard to temporary work or the temporary loan of labour?

- What are the accommodation conditions for an employee who is away from his usual place of work?

- Which national authority controls the application of the posting rules?

- What penalties exist in the area of posting?

- End of employment contracts

- Dismissal

- Resignation

- In what form should a resignation be submitted to an employer?

- Must an employer be informed of the reason for a resignation?

- What is the notice period for resignation?

- What is the starting point of the notice period?

- What is the penalty if an employee fails to comply with the notice period?

- Can the notice period be offset against the employee's remaining leave?

- Can a person be exempted from serving a notice period following a resignation?

- In what cases can a person resign without notice?

- Legal action for wrongful dismissal

- Imprisonment

- Automatic termination of employment contract

- Certificate of employment

- Does the employer have to issue a work certificate at the end of the employment contract?

- Does an employment certificate have to be issued for an employee with a fixed-term employment contract?

- What if the employer refuses to issue a work certificate despite the employee's request?

- What should an employment certificate contain?

- What to do if the certificate contains unfavourable statements?

- Non-competition clause

- What is a non-competition clause?

- Can an employer prohibit an employee from being poached by a competitor?

- Can a non-competition clause result from a verbal agreement between the employer and the employee?

- Under what conditions is a non-competition clause valid?

- Can a non-competition clause be added to an employment contract during its term?

- Business ownership transfer

- What is meant by a business transfer?

- What is meant by a transferor?

- What is a transferee?

- To whom do the rules on the employment of employees apply in the event of a business transfer?

- What happens to employees' employment contracts when ownership of a business is transferred?

- What about the transferor and transferee's liability?

- What are the obligations of the transferor and the transferee?

- What about the collective rights of employees in the event of a company transfer?

- Can the transfer of a business be a reason for dismissal?

- What obligations do the transferor and the transferee have with regard to providing information and consultations?

- What is the impact of the transfer on the status of employee representatives?

- Unemployment compensation

- Who can be compensated for the loss of a job?

- How can a person receive unemployment benefits?

- How long can the unemployed person receive benefits?

- Are unemployment benefits payable if I lose my part-time job?

- Are employees who are ill at the end of their notice periods entitled to unemployment benefits?

- How much are unemployment benefits?

- Are unemployment benefits reduced if an unemployed person earns money intermittently?

- When do unemployment benefits end?

- Legal action before the Labour Tribunal

- Health & safety in the workplace

- Employees concerned

- Responsible players

- Occupational Health Services

- Pre-employment medical examination

- Are employees required to undergo a pre-employment medical examination?

- What is the purpose of the pre-hiring medical examination?

- In what cases are employees subject to periodic medical examinations?

- What is an at-risk position?

- What if an employee has been declared fit for work?

- What if an employee has been declared unfit for work?

- Place of work

- Illness

- Reclassification

- What does the Social Security Medical Board (CMSS) do with a long-term sick employee?

- What happens if CMSS considers the employee fit for work?

- What happens if CMSS considers that the illness is lasting?

- What happens if the CMSS discovers a disability?

- What happens if CMSS recommends internal or external reclassification?

- Am I protected against dismissal?

- Can I be internally reclassified?

- Can I be reclassified externally?

- CSL publication

- Occupational accidents and diseases

- Pregnant women, young people and disabled workers

- Harassment

- Discrimination

- Alcohol, drug abuse, smoking

- Social dialogue

- Staff representation

- Setting up staff delegations

- Composition of the staff delegation

- Appointment of the staff delegation

- Duration and end of the mandate

- Remit of the staff delegation

- Health and Safety Representative

- Equal Opportunity Officer

- Resources available to the staff delegation

- Organization and functioning

- Status of employee delegates

- Litigation

- Délégation au niveau de l’entité économique et sociale

- Employee representatives in limited companies

- Collective labour agreements

- National Conciliation Office (ONC)

- Negotiation of a collective labour agreement

- Parties to the collective agreement

- Agreements on inter-professional social dialogue

- Observatoire des relations professionnelles et de l’emploi (ORPE)

- Arbitration

- Content of the collective labour agreement

- Signature and entry into force of the collective agreement

- Staff representation

- Third country nationals

- Definitions

- Stay of less than three months

- Stay of more than three months

- Residence permit for highly skilled employment

- Work permits for seasonal workers

- Residence and work permit for self-employed persons and investors

- Residence permits for athletes

- Residence permit for students, pupils, trainees, volunteers or au pairs

- Residence permit for researchers

- Family reunification

- International protection

- Frontier workers

- Youth

- Permanent employment contract (CDI)

- Fixed-term employment contract (CDD)

- Employing school pupils and college students during academic holidays

- What are the features of this type of employment?

- Who can work as a pupil or student during academic vacations?

- Is there a maximum employment time?

- Is it necessary to enter into a contract?

- What should the contract say?

- How much is the pupil's/student's remuneration?

- Do pupils/students have to pay taxes?

- Is the pupil/student entitled to state financial assistance for higher education?

- Does the pupil/student need to be registered for social security?

- Is the pupil/student entitled to time off?

- Do pupils/students benefit from special protection?

- Can the contract be terminated before it expires?

- Who supervises the employment of pupils/students?

- Which court has jurisdiction in case of disputes?

- Internship

- Employment support contract (CAE)

- Who is eligible?

- How to find an available position?

- How is the contract concluded?

- How long does it last?

- How long does the young person work?

- How is the young person supervised?

- How is a young person evaluated?

- What is the young person's remuneration?

- What are the common law rules that apply?

- What are the young person's obligations?

- What assistance is available to the employer?

- How is the employer encouraged to hire the young person at the end of the contract?

- How does the contract end?

- CSL Publication and Case law

- Employment initiation contract (CIE)

- Who is eligible?

- How to find an available position?

- How is the contract concluded?

- How long does it last?

- How long does the young person work?

- How are young persons supervised?

- How is the young person evaluated?

- What is the young person's remuneration?

- What are the common law rules that apply?

- What assistance is available to the employer?

- How is the employer encouraged to hire the young person at the end of the contract?

- How does the contract end?

- What are the employer's obligations at the end of the contract?

- CSL Publication and Case law

- Social security

- Accidents

- Dependency

- Pensions

- Old age pensions

- What are the two main pension schemes in Luxembourg?

- How is the general scheme financed?

- What are the sources of funding for the general scheme?

- Under what conditions are pensions awarded?

- What are the different insurance periods?

- What are the procedures for applying for an old-age pension?

- What remedies are available?

- What is used to calculate the old-age pension?

- What are the minimum and maximum old-age pensions?

- What is the lump-sum child-rearing allowance?

- What happens if an old-age pension combined with other income?

- What amounts are withheld from old-age pensions?

- When can a refund of contributions be requested?

- Disability pension

- Survivor’s pensions

- Useful information

- Old age pensions

- Aid

- Unemployment

- Family benefits

- What are the main amounts related to family benefits?

- The Children's Future Fund

- What are the different types of family benefits?

- What are the steps to obtain the benefits?

- What about payment of benefits?

- How are family benefits organised in the EU?

- What about the prescription of benefits?

- What about the assignment, pledging and seizure of benefits?

- What about undue benefits?

- What about penal provisions?

- Useful information

- CSL Publication

- REVIS

- What is a Social Inclusion Income (SII)?

- Who can benefit from REVIS?

- How is the REVIS calculated?

- Under what circumstances should the inclusion allowance be returned?

- How do I apply for a REVIS?

- What transitional provisions apply to recipients of the RMG?

- What are the remedies?

- What other public aid is available?

- Useful informations

- CSL Publication

- Housing

- Educational bursaries

- How has the graduate financial aid system evolved in recent years?

- What is new with the 29 October 2019 law?

- Who is eligible for state student financial aid?

- What financial aid is available to students?

- For how many semesters can a student receive financial aid?

- What steps must a student take to receive graduate financial aid?

- What documents should be submitted with an application for financial aid?

- What appeals of a decision to refuse financial aid are possible?

- Payroll taxation

- Legal library

- Employees

- Health, well-being and security at work

- Quality of Work Index Luxembourg

- Stressberodung

- Preventing psychosocial risks

- Your rights: Health & safety in the workplace

- Awareness campaign “Prevention of health risks in the workplace”

- Newsletter

- Initial professional training

- Presentation

- Public school system

- Apprenticeship

- Ready for an apprenticeship? Here's how to get started...

- What are the advantages of a vocational training under an apprenticeship contract?

- How does a typical apprenticeship training program work?

- Which trades / professions are organized under an apprenticeship contract?

- What are the rights and obligations of an apprentice?

- Who should the apprentice talk to during their apprenticeship?

- What about adult education?

- What about cross-border learning?

- What about apprenticeship benefits?

- Professional training courses

- Which vocational courses include internships?

- How do I find an internship position?

- Do I have to sign an internship agreement?

- What should the student intern commit to?

- What does the training organization have to commit to?

- What are the responsibilities of tutors in the school and professional environment?

- How is the placement course evaluated?

- What is the daily attendance time of student trainees in the training organization?

- Do student trainees get school holidays and vacations?

- Do student trainees receive compensation during the internship?

- What should the student trainee do in case of illness or absence?

- Are student trainees insured against accidents?

- What other protective provisions apply to student trainees?

- What happens if the course is interrupted?

- Can the internship agreement be interrupted?

- Useful information

- “Choose the Apprenticeship Route / Join 2,000 Apprentices” campaign

- Economic pages

- Events

- Library

- 100 years CSL

What is the Luxembourg tax rate like?

Applied to the rounded adjusted taxable income, the Luxembourg income tax rate in force is as follows.

This rate corresponds to that of class 1.

- 0% for the income bracket below €12,438

- 8% for the income bracket between €12,438 and €14,508

- 9% for the income bracket between €14,508 and €16,578

- 10% for the income bracket between €16,578 and €18,648

- 11% for the income bracket between €18,648 and €20,718

- 12% for the income bracket between €20,718 and €22,788

- 14% for the income bracket between €22,788 and €24,939

- 16% for the income bracket between €24,939 and €27,090

- 18% for the income bracket between €27,090 and €29,241

- 20% for the income bracket between €29,241 and €31,392

- 22% for the income bracket between €31,392 and €33,543

- 24% for the income bracket between €33,543 and €35,694

- 26% for the income bracket between €35,694 and €37,845

- 28% for the income bracket between €37,845 and €39,996

- 30% for the income bracket between €39,996 and €42,147

- 32% for the income bracket between €42,147 and €44,298

- 34% for the income bracket between €44,298 and €46,449

- 36% for the income bracket between €46,449 and €48,600

- 38% for the income bracket between €48,600 and €50,751

- 39% for the income bracket between €50,715 and €110,403

- 40% for the income bracket between €110,403 and €165,600

- 41% for the income bracket between €165,600 and €220,788

- 42% for the income bracket exceeding €220,788

The other tax rates used, in particular the scales of class 1a and 2, are deducted from this basic class 1 rate.

This rate is increased by the solidarity tax, which is currently 7%, or even 9% for taxable incomes of more than €150,000 in tax class 1 and 1a or more than €300,000 in tax class 2.

(Last updated on 31.01.2024)

How do I determine my tax rate?

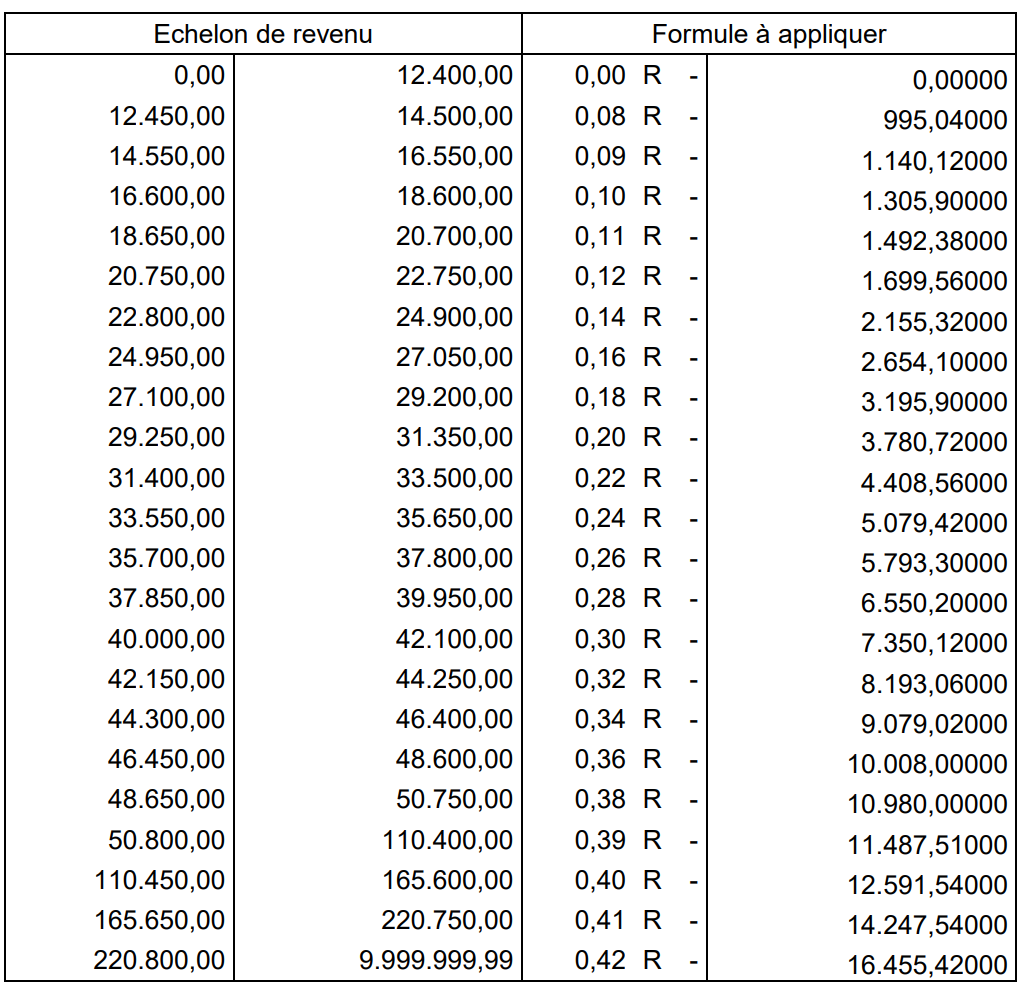

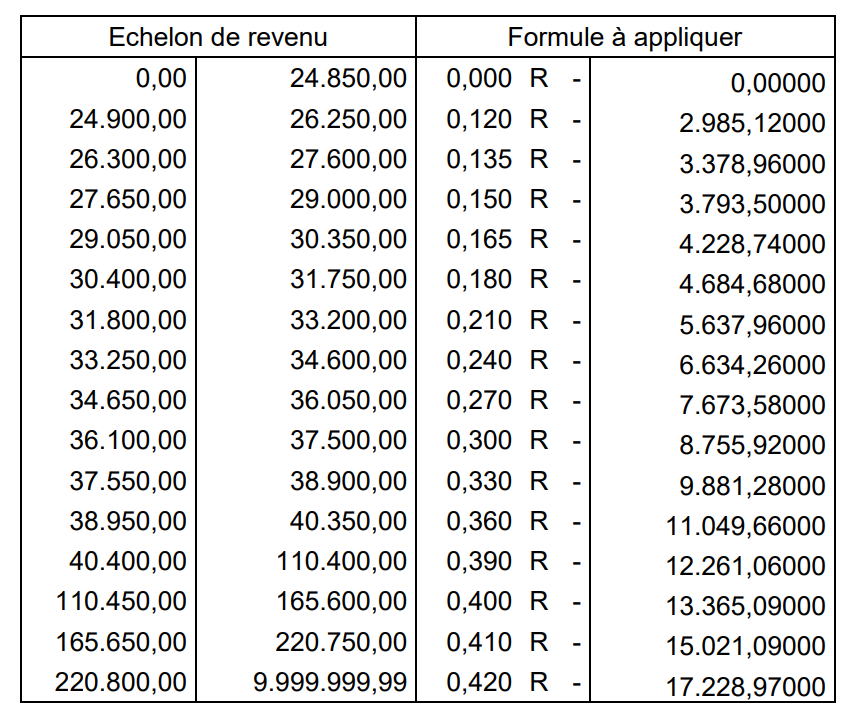

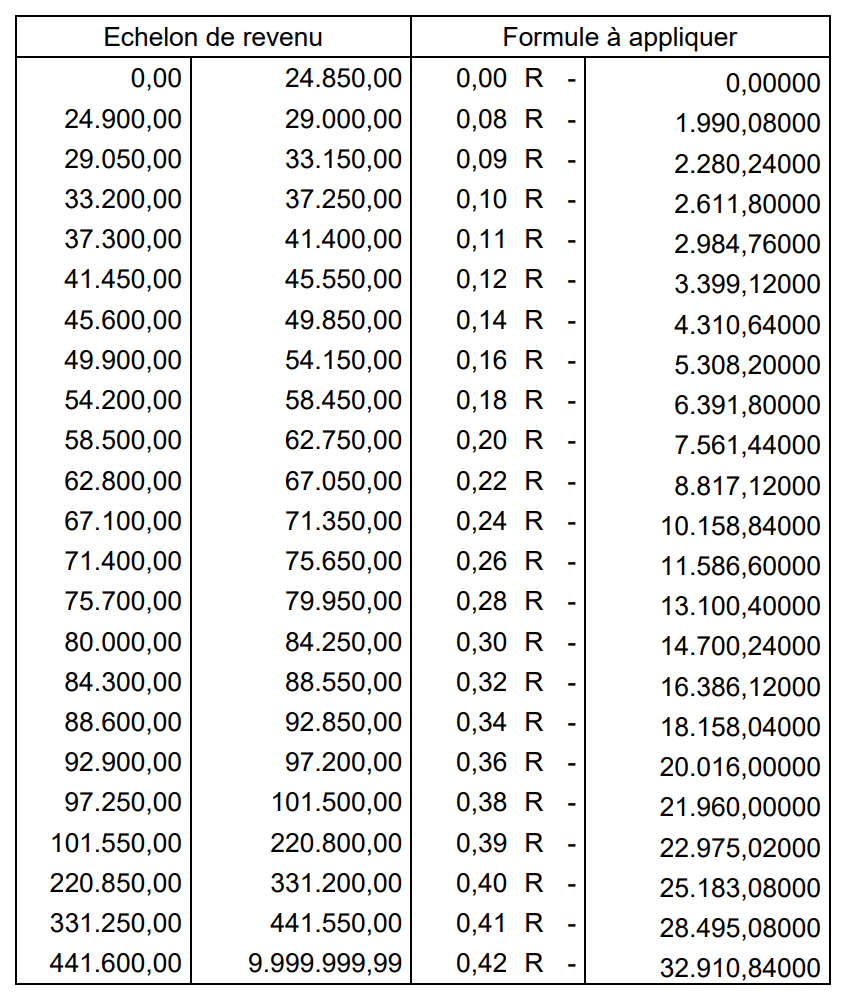

To determine the amount of your tax rate, or your share of tax, apply the formula in the following tables from the official tax scale, where R is your total adjusted taxable income (i.e. after deducting everything you can from your gross income) which you multiply by your marginal tax rate (e.g. 20% if your income falls into the adjusted taxable income bracket between €29,250 and €31,350 in class 1) and from which you then have to subtract the flat-rate amount corresponding to your income bracket (last column).

For example: 29,250 x 0.20 – 3,780.72 = €2,069.

Luxembourg adds a solidarity tax (paid into the Employment Fund) to your rating, which is currently 7%, or even 9% for taxable income of over €150,000 in tax classes 1 and 1a, or over €300,000 in tax class 2.

Accordingly, (€2,069 x 1.07) = €2,213 is the amount of solidarity tax you owe on your taxable income of €29,250.

Don’t forget that the contribution to the long-term care insurance, which unlike social security contributions, is non-deductible, also influences the amount of disposable income after contributions (1.4% of gross income after deduction of an allowance corresponding to a quarter of the SSM).

You can also consult the tax calculator of the Direct Tax Administration to obtain this result

(http://www.impotsdirects.public.lu/baremes/personnes-physiques/index.html).

Class 1:

Class 1a :

Class 2 :

(Last updated on 31.01.2024)

Tax credits

Until 2016, each employee/retiree was also automatically credited with €300 per year under the employee or pensioner tax credit. From 2017 onwards, this tax credit has been made income-contingent and degressive. This wage earner tax credit (CIS) due to you, if any, therefore reduces your tax rate. The maximum amount for this is 600 euros from 2024 for a gross salary between €11,266 and €40,000. The CIS is no longer allocated above a gross annual salary of €80,000.

The single-parent tax credit, granted on application, amounts, where applicable for taxpayers in class 1a, to a maximum of €2,505 for an adjusted taxable income of less than €60,000. It is gradually reduced to 750 euros for an income of 105,000 euros. It is also proportional to the period of liability during the tax year (CIM 2023).

In support of taxpayers in possession of a tax form and receiving an income from a taxable salaried occupation in Luxembourg in the area of the minimum wage, a monthly tax credit (CISSM) chargeable through withholding on salaries and wages has been introduced. This tax credit amounts to €70 per month (maximum €840/year) if the gross monthly salary for a full month of full-time work is between €1,800 and €3,000. If this salary is between € 3,000 and € 3,600, the CISSM amounts to € 70 / 600 x (3,600 – gross monthly salary) per month.

If the employee did not work a full month and full time, his CISSM is prorated according to a fictitious gross monthly salary that the employee would have earned if he had been employed for a full month and on a full-time basis under the same remuneration conditions, as well as the number of hours actually worked. The tax credit is not awarded if the gross (notional) salary is below the predefined threshold and ceiling.

The CO2 tax credit for employees (CICO2) is granted to compensate for the levying of the carbon tax (on CO2). This tax credit at its full rate is worth 168 euros. It was introduced in 2024 on the basis of part of the CIS that already covered this carbon tax compensation. It is granted in full for a gross annual salary of €936 up to a salary of €40,000 per year and is then gradually reduced up to a gross salary of €80,000 per year, beyond which it is no longer due.

(last updated on 31.01.2024)